Jump to Sections: Links by Chapter | Book Resources/Downloads

Thank you for buying the book!

We hope you’ve enjoyed the book and have found it both useful and fun – and we’re glad you’re here to get more information, useful links, and downloads/tools. Knowledge is power.

Below, find all the reference links organized by chapter, along with the resources/downloads referenced in Chapter 4 (Cost Accounting Standards), Chapter 5 (Chart of Accounts), Chapter 7 (Indirect Rates), and Chapter 12 (Budgets).

Please leave me a review!

Please rate my book on Amazon or wherever you bought it! Online bookstores are more likely to promote a book when they feel good about its content, and reader reviews are a great barometer for a book’s quality. If able, please add a picture of you holding the book – it increases the likelihood your review will be accepted!

Thank you for your consideration!

– Robert E. Jones, Author

Links by Chapter

Resources

Rules & Regulations

- DCAA > Customers > Guidance > Audit Process Overview – Information For Contractors

- FASB Accounting Standards Codification®

- Chapter 8 – Cost Accounting Standards (dcaa.mil)

Chapter 1: Ten Principles of Accounting

Chapter 2: Ten Principles of GAAP

Chapter 3: Federal Acquisition Regulations & Supplements

- FAR | Acquisition.GOV

- Regulations | Acquisition.GOV

- Federal Register :: Home – Wednesday, September 13th

Chapter 16: Developing Your First Cost and Price Proposal

- casb-cmf.PDF (ornl.gov)

- Part 9904 – Cost Accounting Standards | Acquisition.GOV

- 215.404-71 Weighted guidelines method.

- Resources – Weighted Guidelines – SpendLogic

- Overview of BLS Statistics on Inflation and Prices : U.S. Bureau of Labor Statistics

- Global Insight is now Economics and Country Risk | S&P Global (spglobal.com)

- Resources – Escalation Calculator – SpendLogic

References

- DCAA > Customers > Guidance > Audit Process Overview – Information For Contractors

- FAR | Acquisition.GOV

- Regulations | Acquisition.GOV

- Chapter 99 | Acquisition.GOV

- FASB Accounting Standards Codification®

- Chapter 8 – Cost Accounting Standards (dcaa.mil)

- What Are the Generally Accepted Accounting Principles? (freshbooks.com)

- Generally Accepted Accounting Principles (GAAP) – Guidelines & Policies

- Pre-Award Survey of Prospective Contractor (Accounting System) | GSA

- Pro Forma: What It Means and How to Create Pro Forma Financial Statements (investopedia.com)

- Cost Accounting Standards: Board Has Taken Initial Steps to Meet Recent Legislative Requirements | U.S. GAO

- Cost Accounting Standards Board Disclosure Statement (archives.gov)

- Part 9904 – Cost Accounting Standards | Acquisition.GOV

- Tangible Property Final Regulations | Internal Revenue Service (irs.gov)

- 252.215-7009 Proposal Adequacy Checklist. | Acquisition.GOV

- casb-cmf.PDF (ornl.gov)

- Copy-of-DD1547-Weighted-Guidelines-Tool.xls (live.com)

- 215.404-71 Weighted guidelines method

- Overview of BLS Statistics on Inflation and Prices : U.S. Bureau of Labor Statistics

- Global Insight is now Economics and Country Risk | S&P Global (spglobal.com)

- Resources – Escalation Calculator – SpendLogic

Book Resources/Downloads

Chapter 4: Cost Accounting Standards

Facilities Capital Cost of Money Calculator

Facilities capital cost of money (FCCOM or COM) is an imputed cost related to the cost of contractor capital committed to facilities. CAS 414, Cost of Money as an Element of the Cost of Facilities Capital, provides detailed guidance on calculating the amount of facilities capital cost of money due under a specific contract. Under CAS 414, a business unit’s facilities capital cost of money is calculated by multiplying the net book value of the business-unit’s facilities investment by a cost of money rate based on the interest rates specified semi-annually by the Secretary of the Treasury under Public Law 92-41. The business-unit’s facilities capital cost of money is then broken down by overhead pool and allocated to specific contracts using the same allocation base used to allocate the indirect costs in the overhead pool.

Facilities capital cost of money is determined without regard to whether the source is owner’s equity or borrowed capital. It is not a form of interest on borrowing by the firm. COM is an allowable cost element for related party rent transactions in accordance with FAR 31.205-36.

Our tool is designed to help you calculate the proper amount of COM for a specific set of assets for a single pool or contract. Since COM is calculated for each pool, you need multiple tabs or worksheets that align with your business structure. Download the template and modify for the assets in use on your contract. Additional assets added to the “Assets” tab will have to be manually added to the “Summary Tab.”

FCCM is the method used to determine the amount reimbursable to the contractor for using its own money to invest in facilities and equipment that benefit the Government instead of using it for other investments for which it could receive a return on the investment.

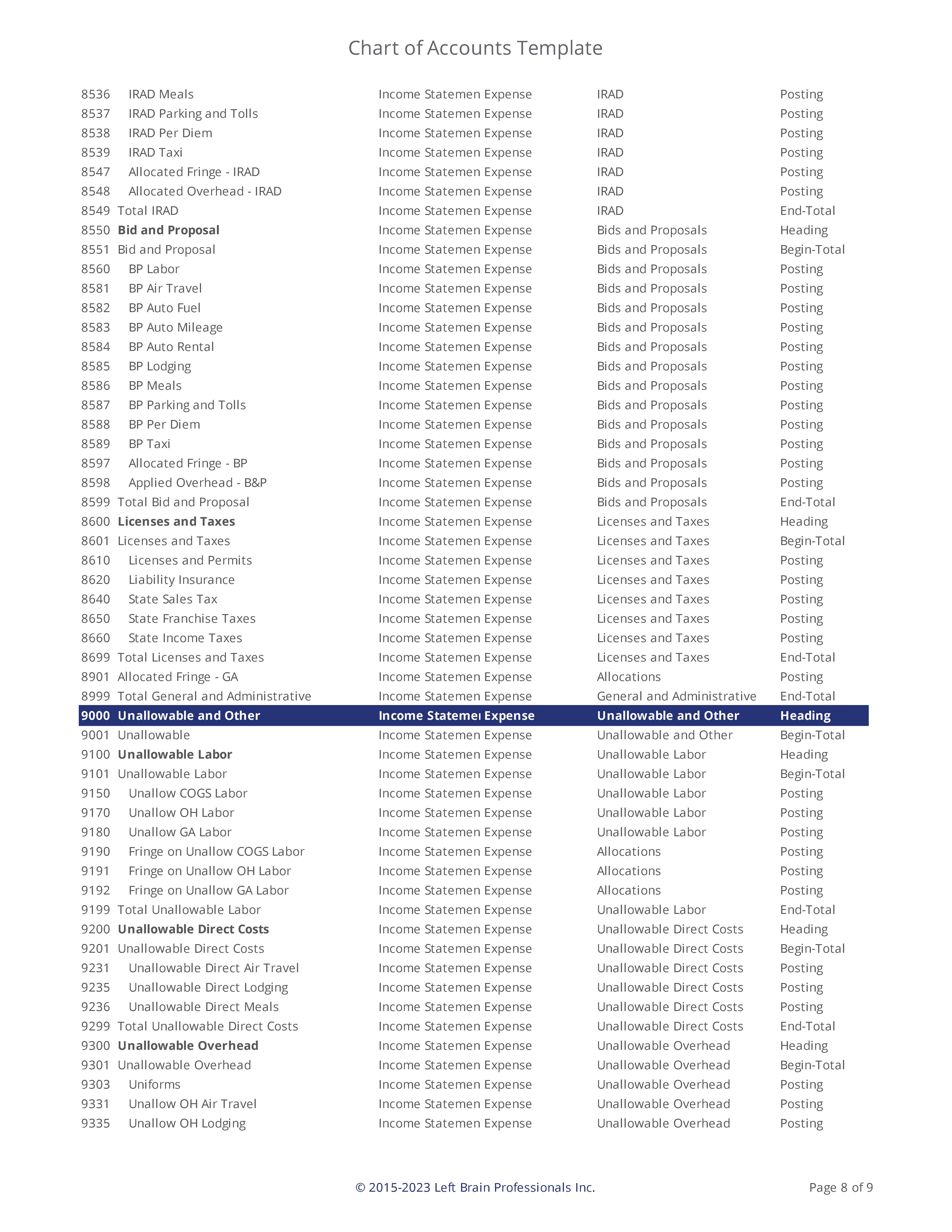

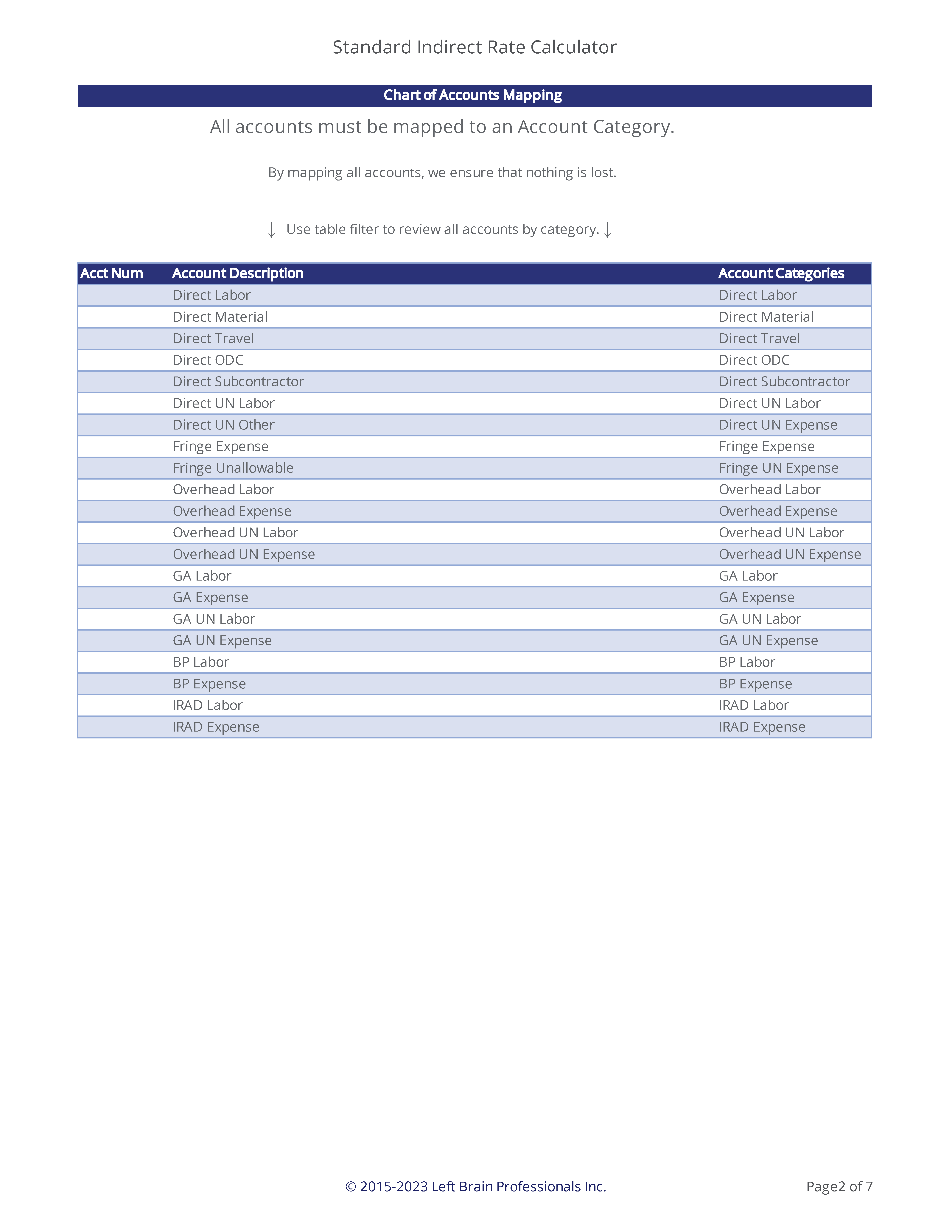

Chapter 5: Chart of Accounts

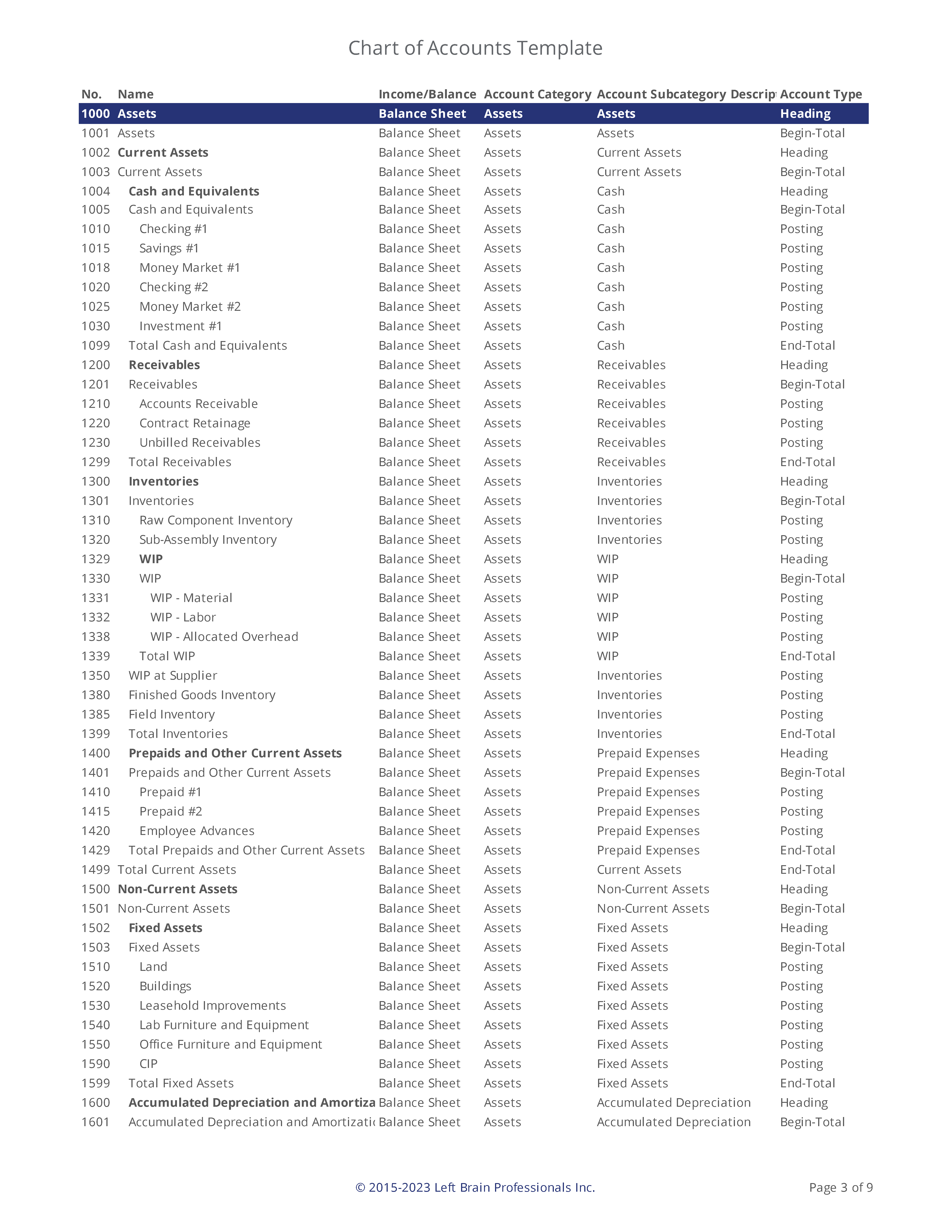

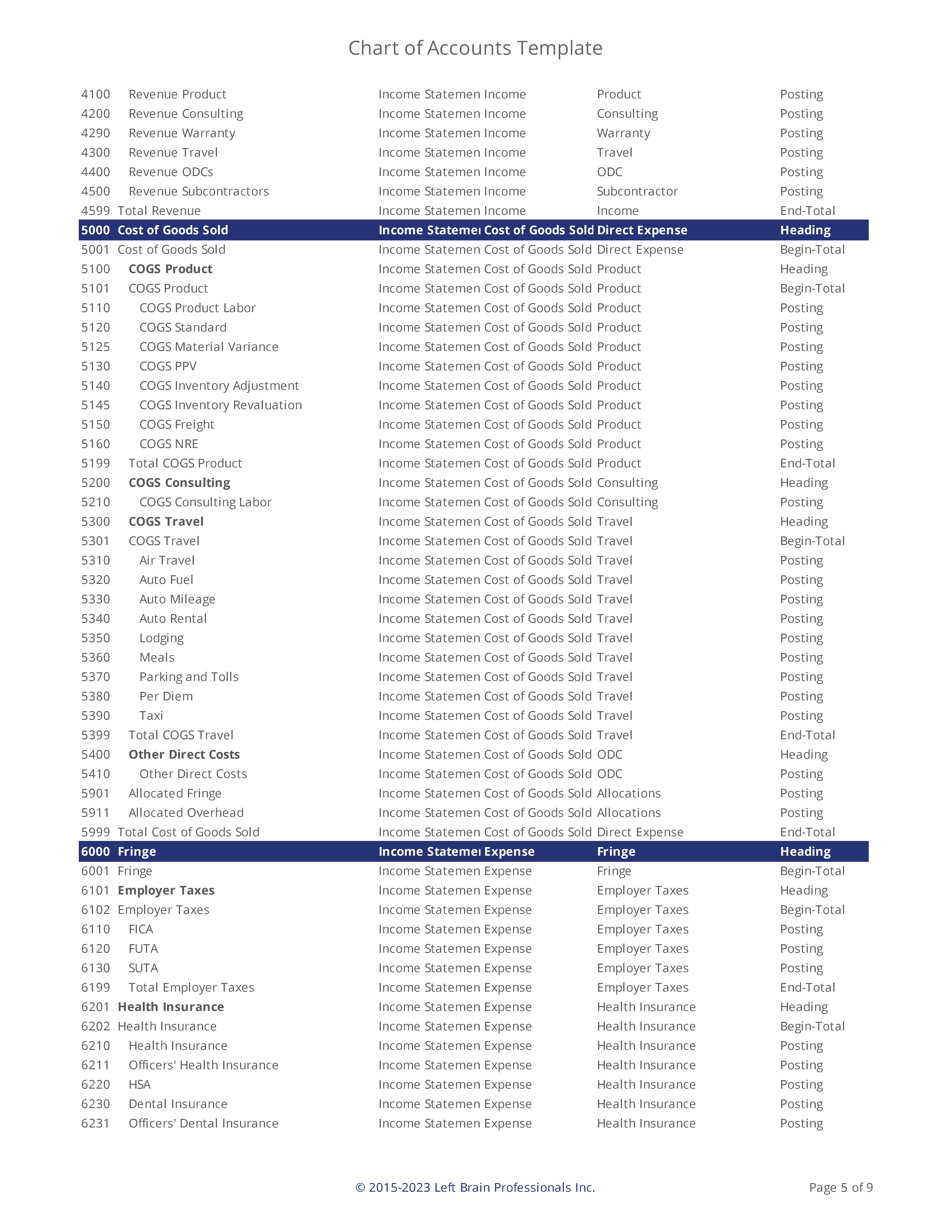

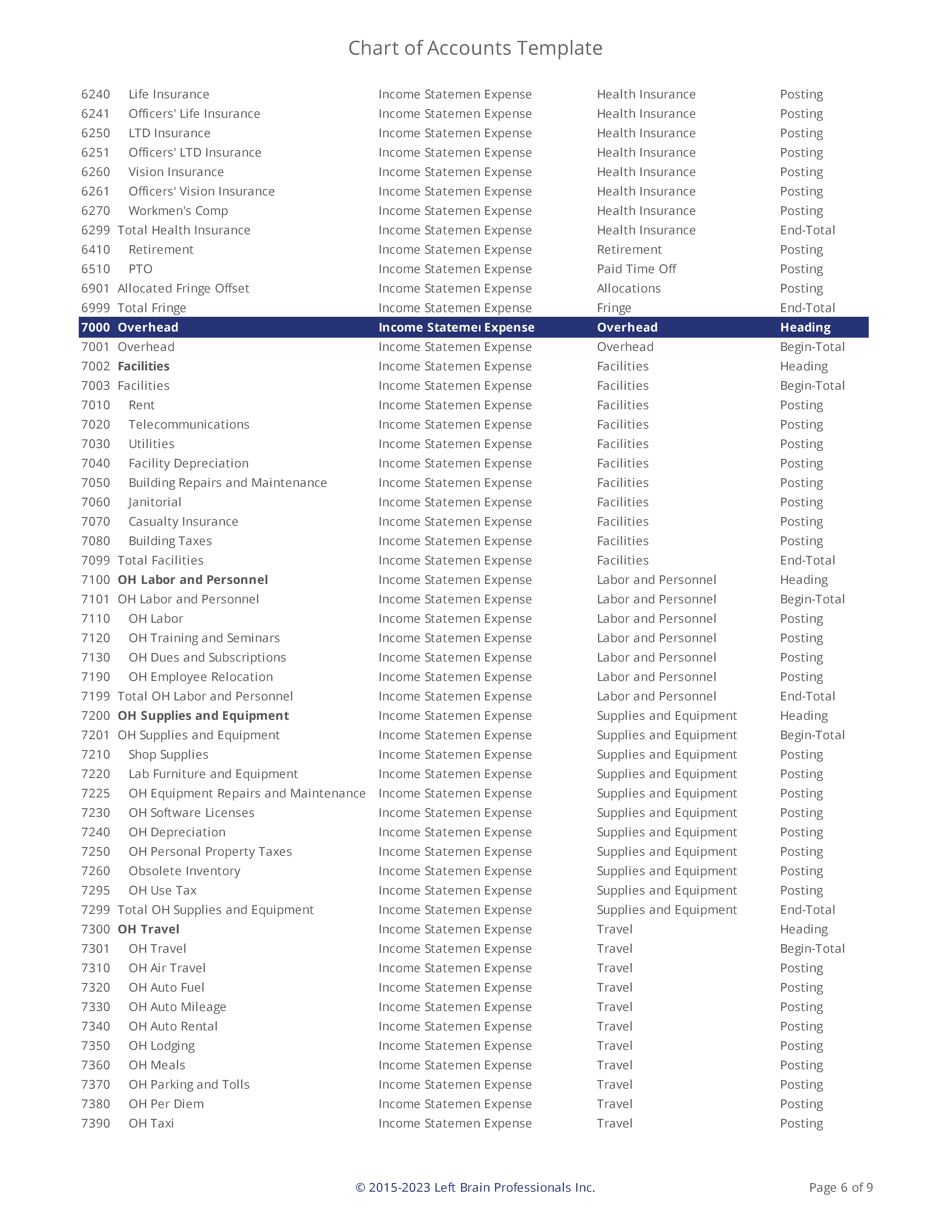

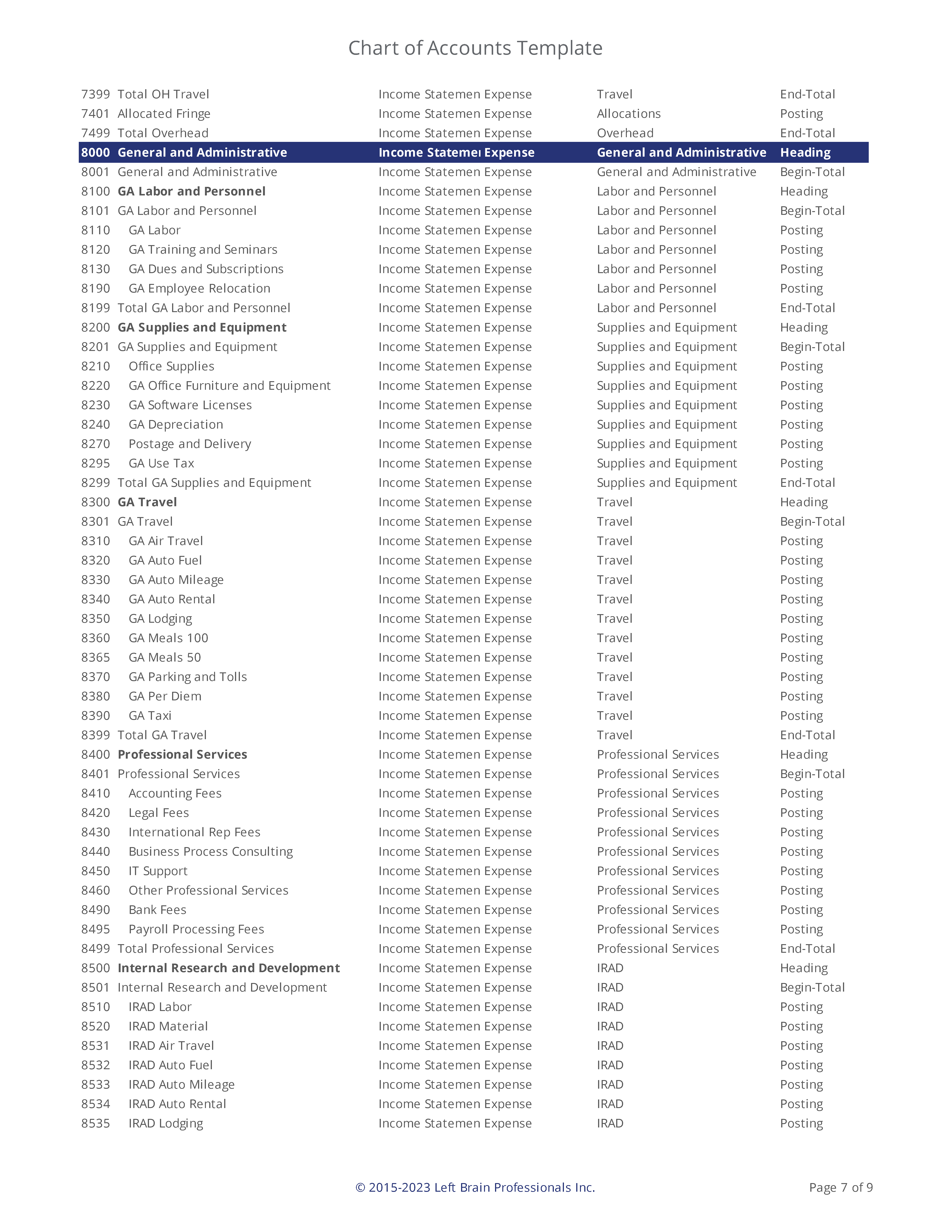

Government contractors are expected to follow an industry standard chart of accounts. While this structure and numbering scheme are not codified or part of any particular regulations, the approach is standard across software platforms, vendors, and consultants.

Our detailed template combines the industry numbering scheme with accounting practices regarding liquidity of assets and timing of liabilities.

Chapter 7: Fundamentals of Indirect Rates

Indirect Rate Calculators

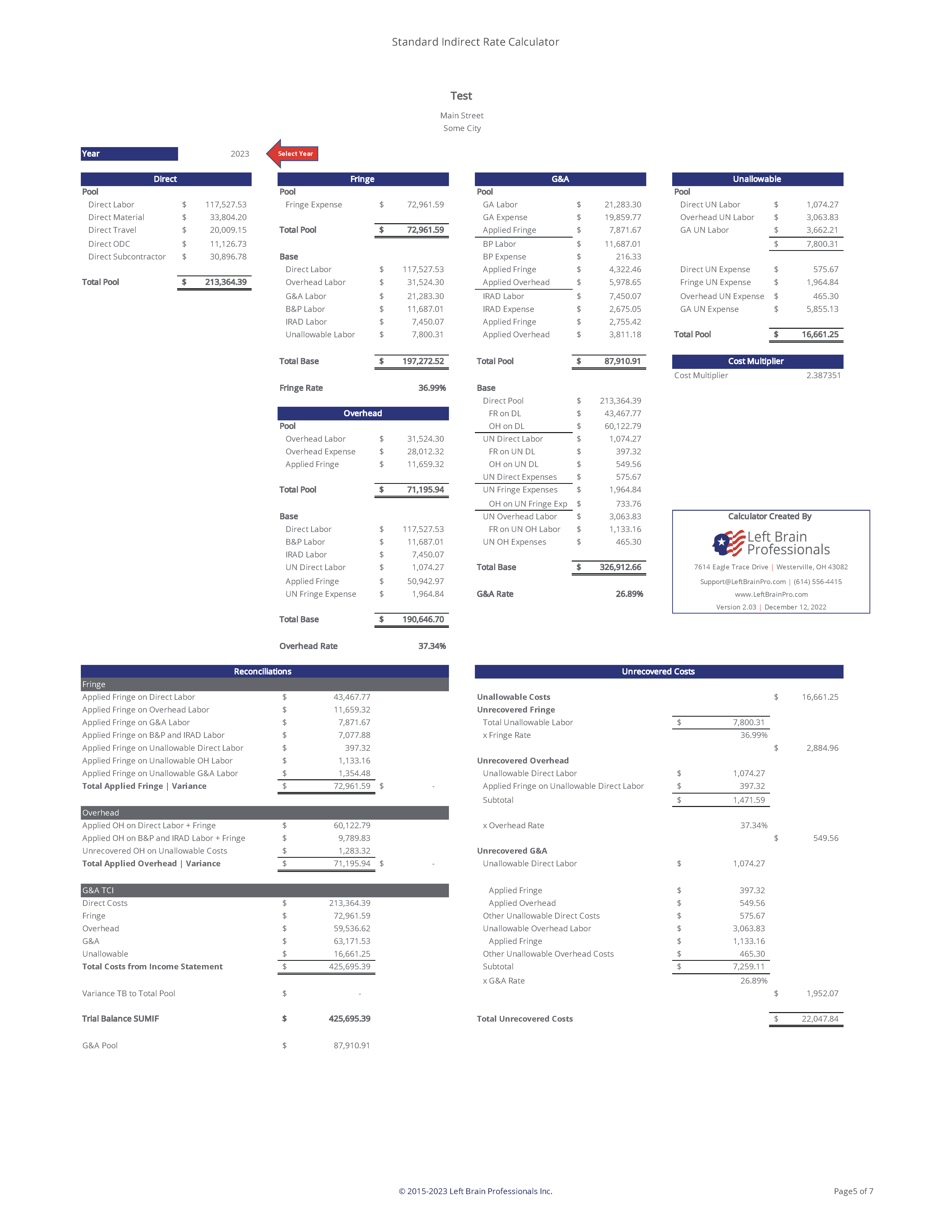

We have multiple versions of the indirect rate calculator. Please select the version that matches your business structure and operations.

- Standard TCI | The Standard TCI version supports a single Fringe, Overhead, and G&A with Total Cost Input (TCI) base.

- Multi-OH TCI | The Multi-OH TCI version supports a single Fringe, up to 3 Overheads, and G&A with Total Cost Input (TCI) base.

- MSOH | The MSOH version supports a single Fringe, Overhead, MSOH, and G&A with Value-Added (VA) base.

- Multi-OH + MSOH | This Multi-OH + MSOH version supports a single Fringe, up to 3 Overheads, MSOH, and G&A with Value-Added (VA) base.

- Single-Element AASHTO | The Single-Element AASHTO version is designed for A/E contractors subject to AASHTO compliance for DOT funds. This version supports Fringe and General Overhead calculation with a single element base of direct labor.

An MSOH pool automatically defaults to a value-added G&A base since materials and subcontracts are moved from the G&A base to the MSOH base.

All versions support multi-year calculations, which helps compare fiscal years or build multi-year budgets.

Our indirect rate calculators also include the following tabs:

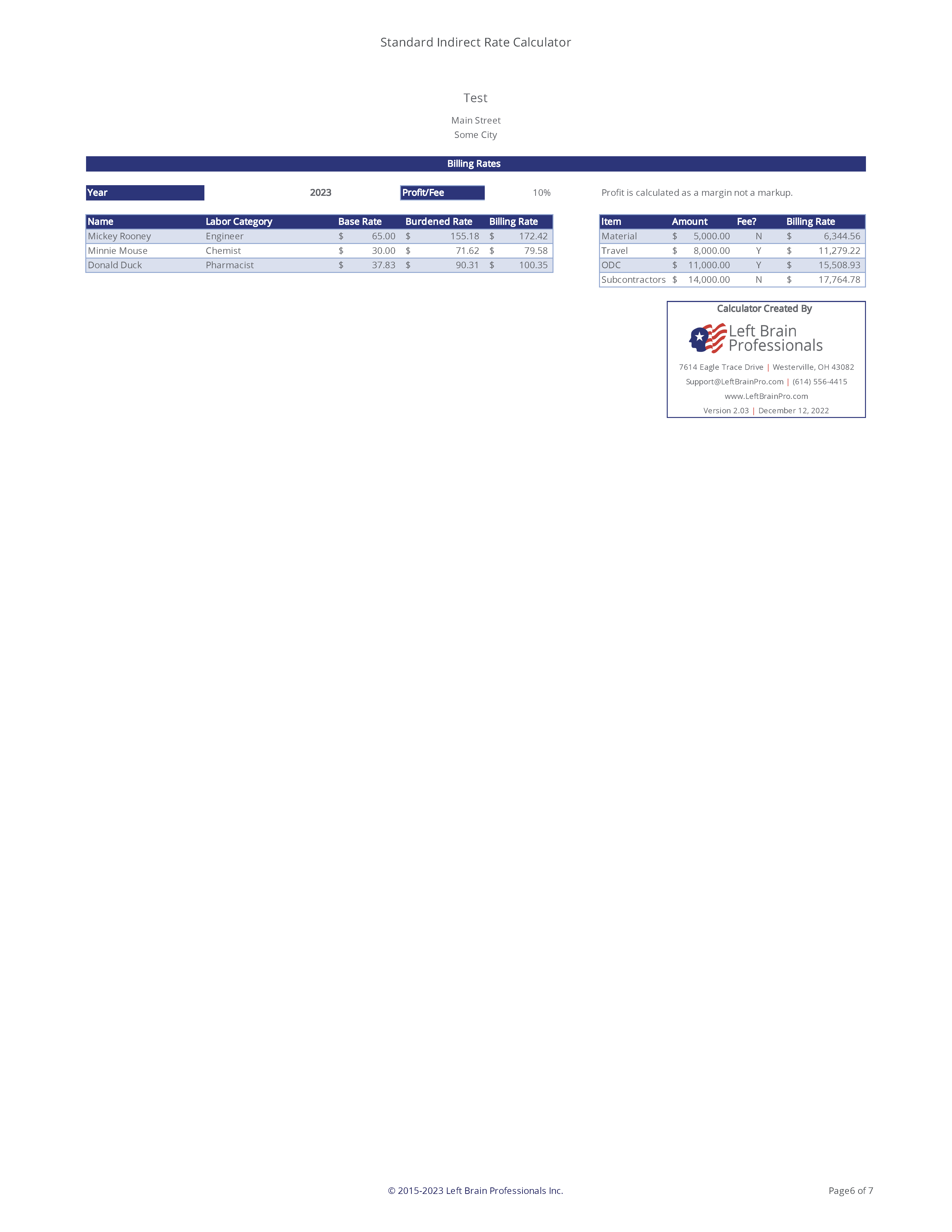

- Billing Rates | This tab allows you to develop billing rates for all employees or labor categories by entering base wages and desired profit margin. The rates automatically update as you make changes to the indirect rates.

- Hiring Rates | This tab tells you how much you can pay an employee based on a known billing rate (often dictated by the contract), your indirect rates, and your desired profit margin. This calculation works in reverse of the Billing Rates tab.

The Billing Rates tab tells you how much to charge based on your costs, and the Hiring Rates tab tells you how much you can afford to pay based on your billing rate and other costs.

Sample Indirect Rate Calculations

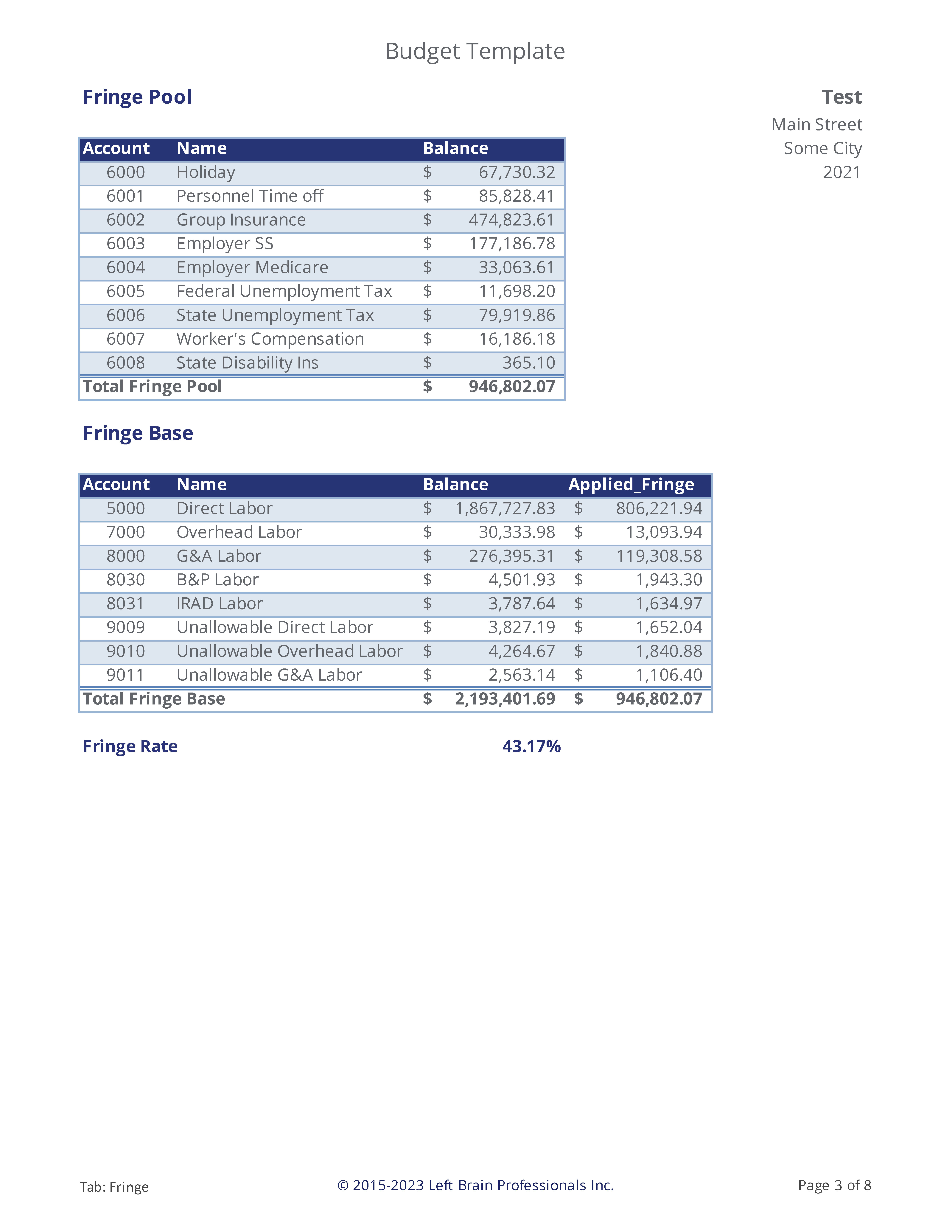

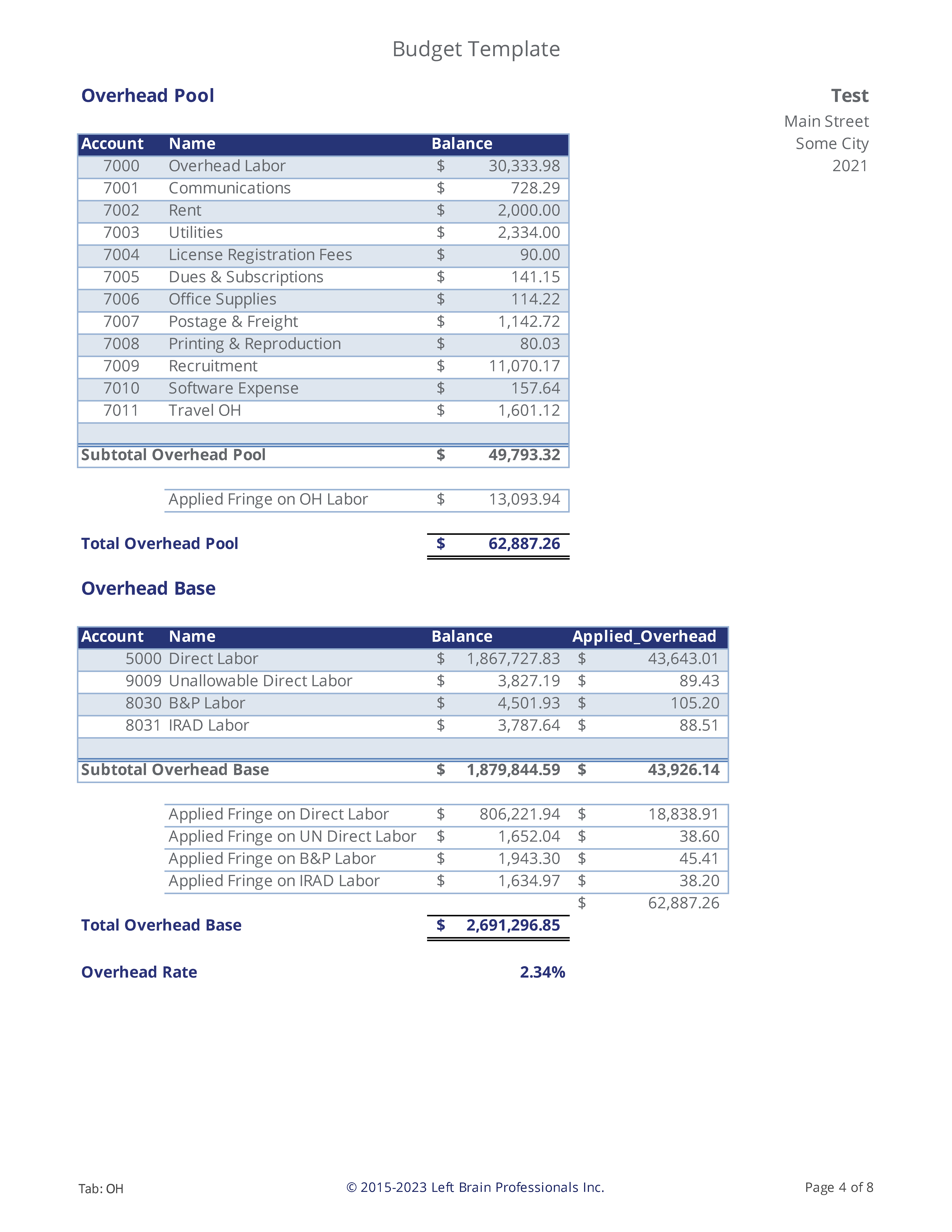

We offer two versions of sample indirect rate calculations so you can see numbers flowing through all of the pools. The standard version shows a single Fringe, Overhead, and G&A (TCI) structure while the advanced version shows a single Fringe, two Overheads, MSOH, and G&A (VA) structure.

Chapter 12: Budgets

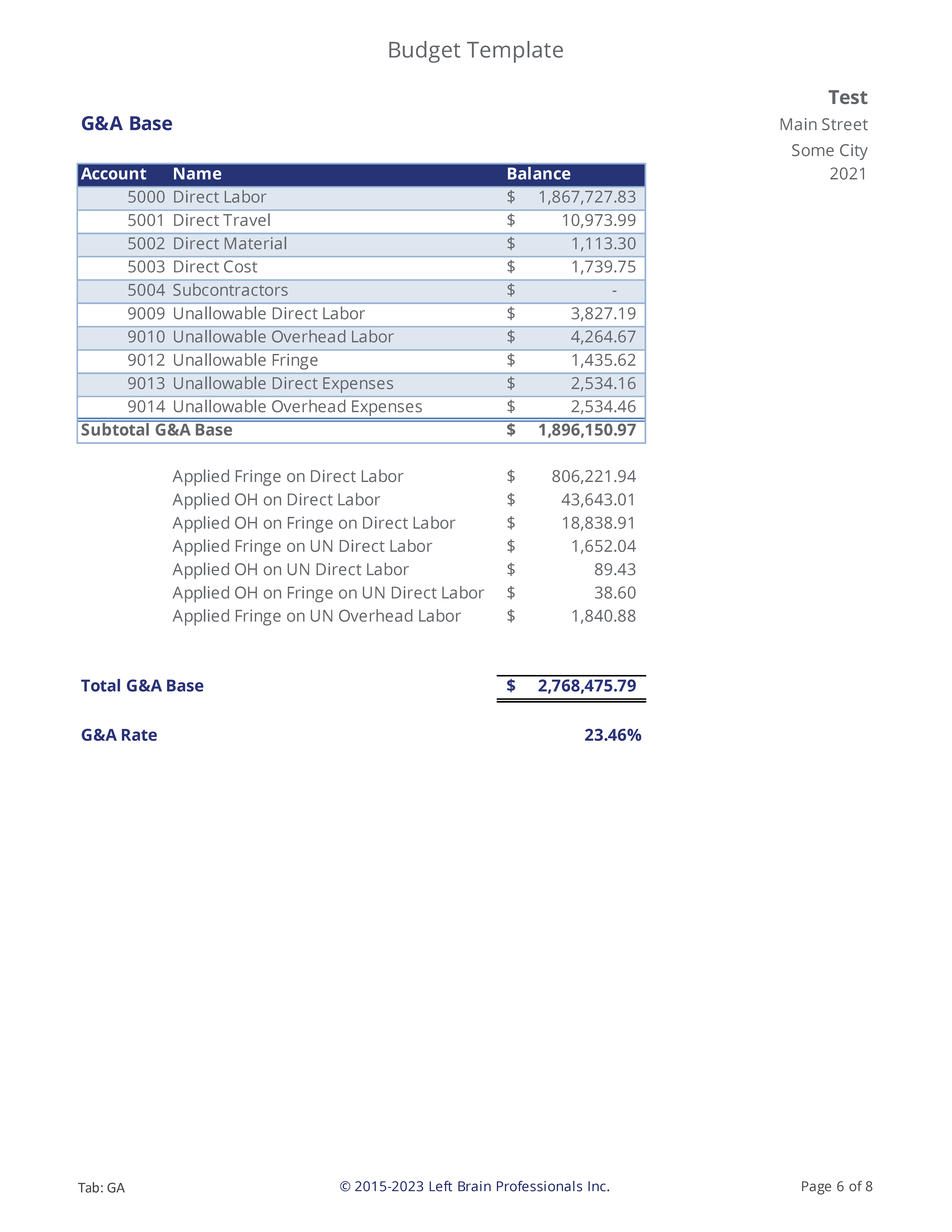

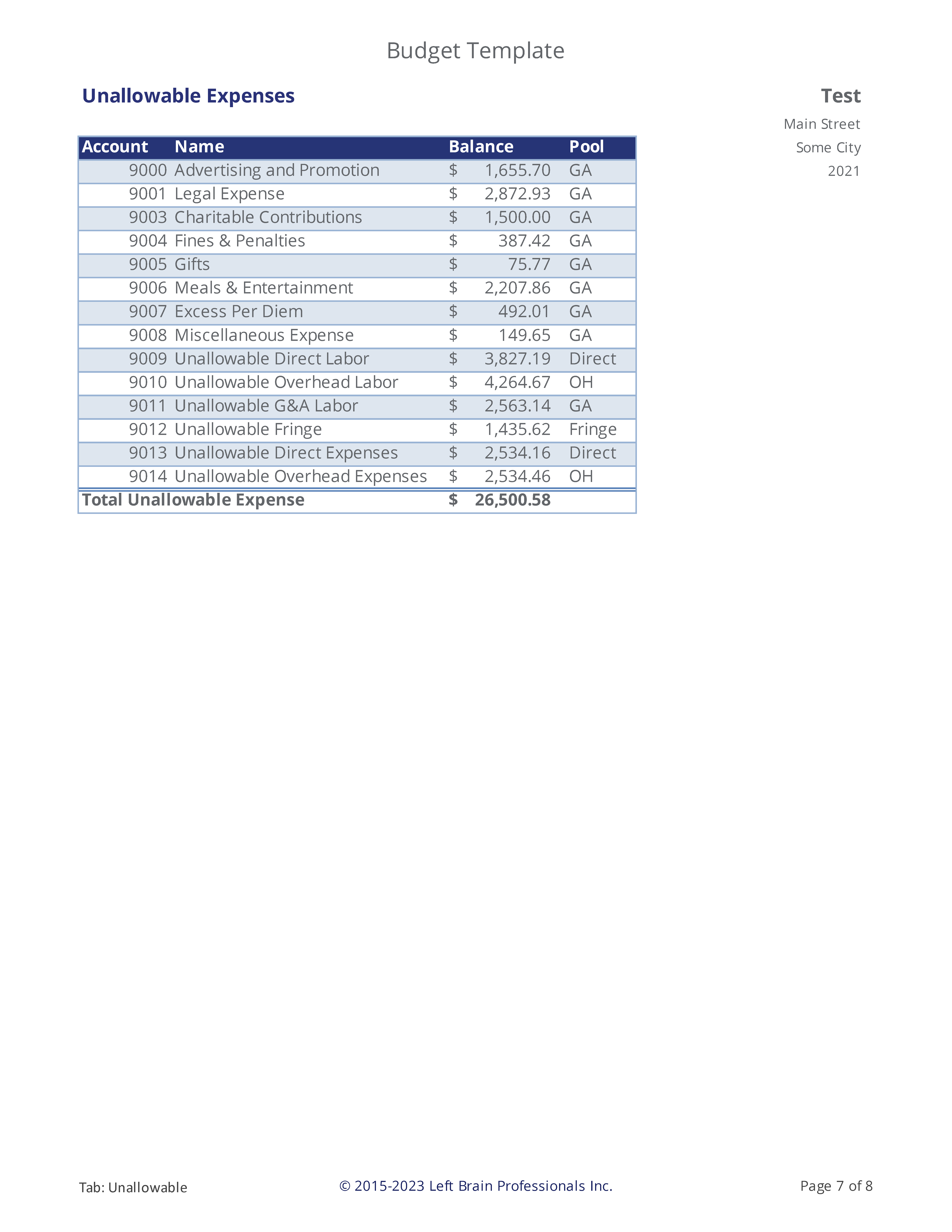

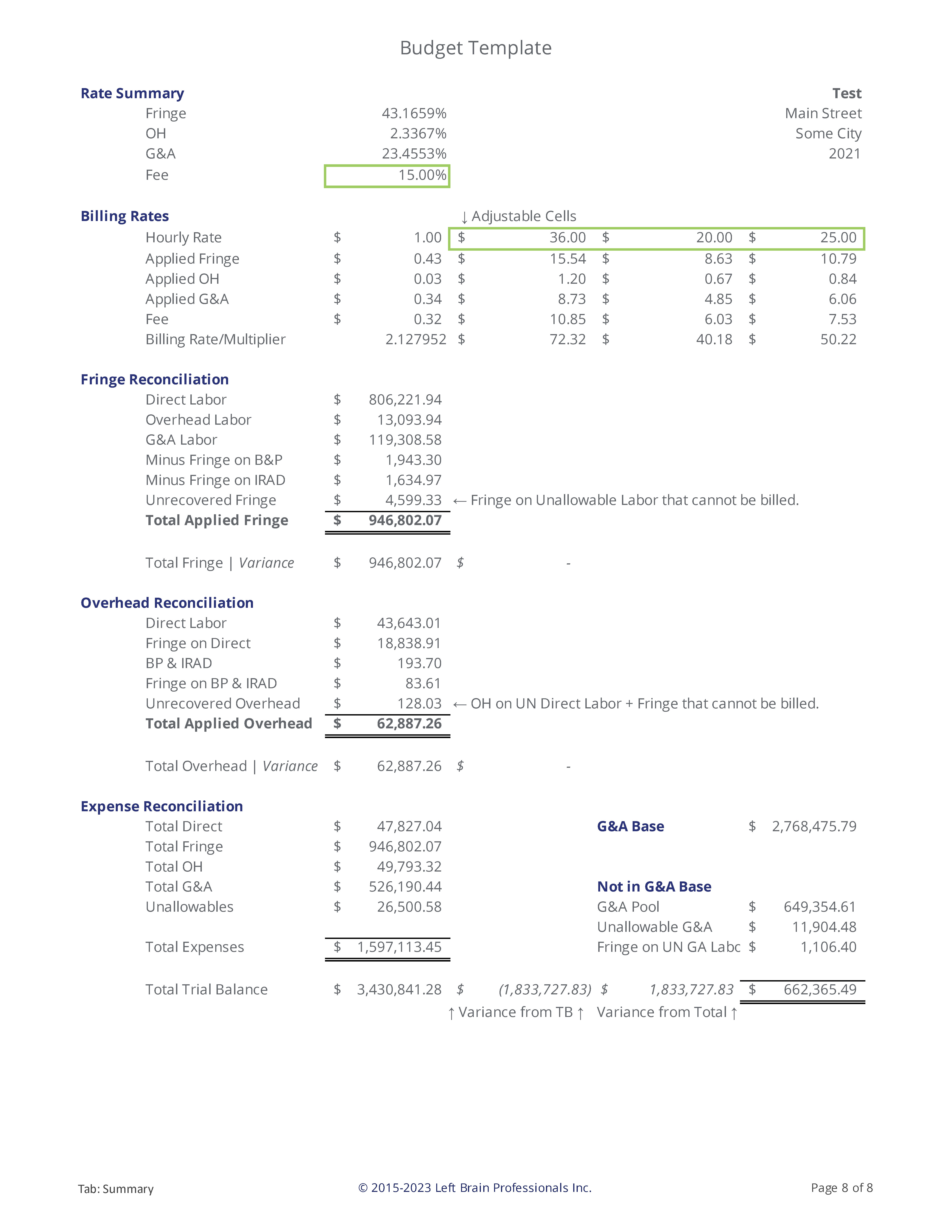

Budget Template

This template is based on a single Fringe, Overhead, and G&A (TCI) and can be easily modified for additional pools. The template is built in tabs allowing you to easily focus on one type of expense at a time. We find this makes the budget process easier. It also includes a labor tab that helps you build all of the related fringe expenses which then automatically flow to the appropriate pools.